Recap:

Weekly Analysis:

Daily Analysis:

Summary:

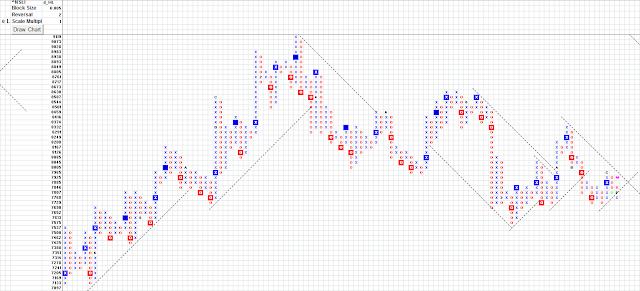

Weekly chart is getting pressure on the BrRL & therefore oscillating within the channel. The consolidation has more possibility to break upside

The Daily chart is showing strength to break up the BrRL.

Breaking above 8000, could take it to 8400 & that break would mean a new bull run. Breaking down 7690 could support 7550.