Recap:

4710 on it's way.

Summary:

4710 on it's way.

Weekly Analysis:

Daily Analysis:

Bottom near 4700. Bears target 4500.

PnF Fundamentals:

As I am not able to dedicate much time to add to my "My P&F Knowledge Share Centre", I thought I will add little bit of my P&F with fellow readers. Though I know there are not many PnF enthusiasts around, I hope to create few through my share.

PO (Price Objective):

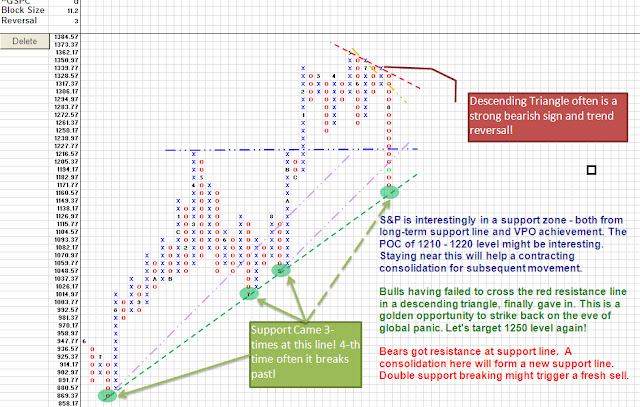

Though I have talked about it earlier, but today would like to share a few more on this. This is a gift to the PnF followers to set a target for a position often. As the word says Price Objective, it sets an objective with a direction of the price movement. It does not necessarily talk about the target but all it means that the objective of a major reversal / pause is to normalize the market valuation to the desired level. There are primarily two types of PO - Vertical Price Objective (VPO) & Horizontal Price Objective (HPO). These are named so not merely from geometric distribution of the price but also from the psychological momentum point of view.

In my earlier topics I have covered the basics of VPO & HPO. So I won't get into the construct of them. Straightway I would start sharing my view point on these two techniques in PnF.

VPO is counted when the price changes the direction following a sharp movement in one direction (in EW this is often the v-th / c wave). HPO is counted when the price halts at certain level and becomes range-bound (in EW this is often the corrective phase). Having said, my experience is HPO is more effective in lower time frame charts compared to VPO, which is more effective in higher time frame charts. So avoid HPO in weekly chart and VPO in hourly chart. VPO is more target oriented whereas HPO is direction oriented. There can be minute VPOs within a large VPO, however, HPOs within HPO is not in my experience. In recent times my observations over VPO has been quite satisfactory (fellow readers can appreciate the accuracy of this technique). Later I will turn up with few more charts and explain.