2008 west preceded the fall. Rather it was the cause of the very fall. East followed. This time how is the story? Trying to evaluate the scene for S&P500 as it looks today.

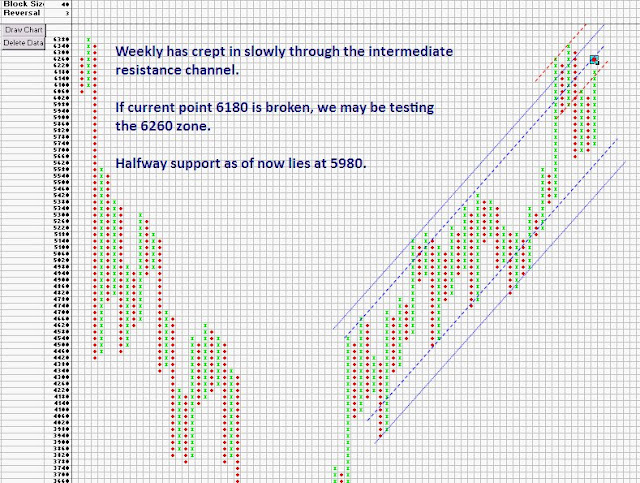

Weekly Chart:

Daily Chart:

Summary:

Weekly chart is quite firm. It does not show any major weakness in weekly chart. Daily chart in short-term shows some stiff resistance either at 1312 or 1372 level. If the fall in East is fundamental enough West can not stay far off for long! Similarly, if West is going strong towards North, it will be interesting to see how long can East go towards South?

Weekly Chart:

Daily Chart:

Summary:

Weekly chart is quite firm. It does not show any major weakness in weekly chart. Daily chart in short-term shows some stiff resistance either at 1312 or 1372 level. If the fall in East is fundamental enough West can not stay far off for long! Similarly, if West is going strong towards North, it will be interesting to see how long can East go towards South?