Merry x-mas to all of you and P&F enthusiasts!

Recap:

Today I want you all to refer this Post on 1st week of March-2011 this talked about 4300 - 4500 as target! Now that was 9 months old reading, even last week's chart read 5800 >> 5000; it did. My belief on P&F has grown stronger day by day.

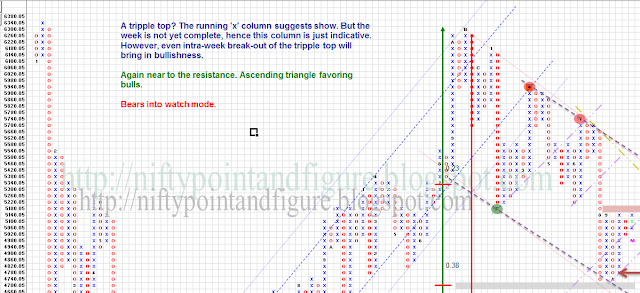

Weekly Analysis:

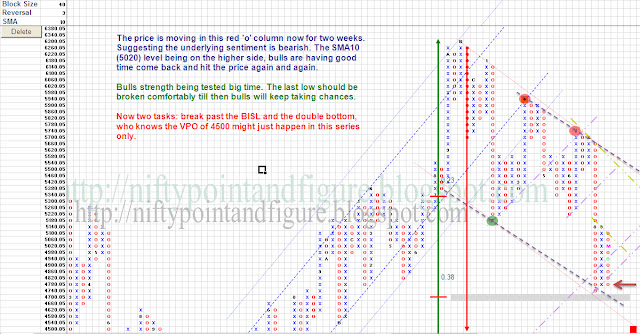

Daily Analysis:

Summary:

Weekly halted, daily UP. If 4660-4680 is held, possibly heading for 4840-4860.

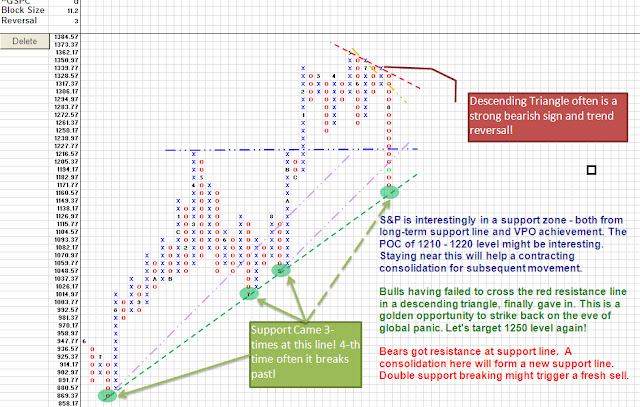

Market is making possibly a bottom. The worst bottom, if not already made at 4540, should be 4300-4340. I am expecting a consolidation, if not a complete reversal from this point. Couple of points that I am considering:

- the channel bottom is being bought by the Bulls again and again.

- many of the nifty 50 stocks have given away a year's complete gain

- (though I don't understand much) Elliott wave suggesting a double zig-zag

- gold and rupees have done enough