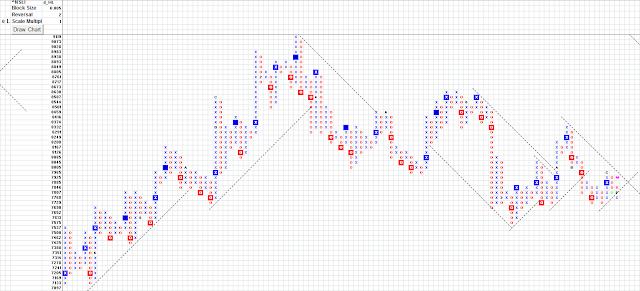

Test of faith would have wonderfully worked, nifty bounced back from the channel bottom. While we expected 6750, it happened at 6800 itself. Nice 1400 pts movement from there.

Weekly Analysis:

Daily Analysis:

Summary:

Weekly chart has BrRL & expected profit booking in mid term.

Daily chart also coincides reaching the VPO.

Hence, profit booking is solicited in mid-term. Long-term outlook stays bullish though.